A new context

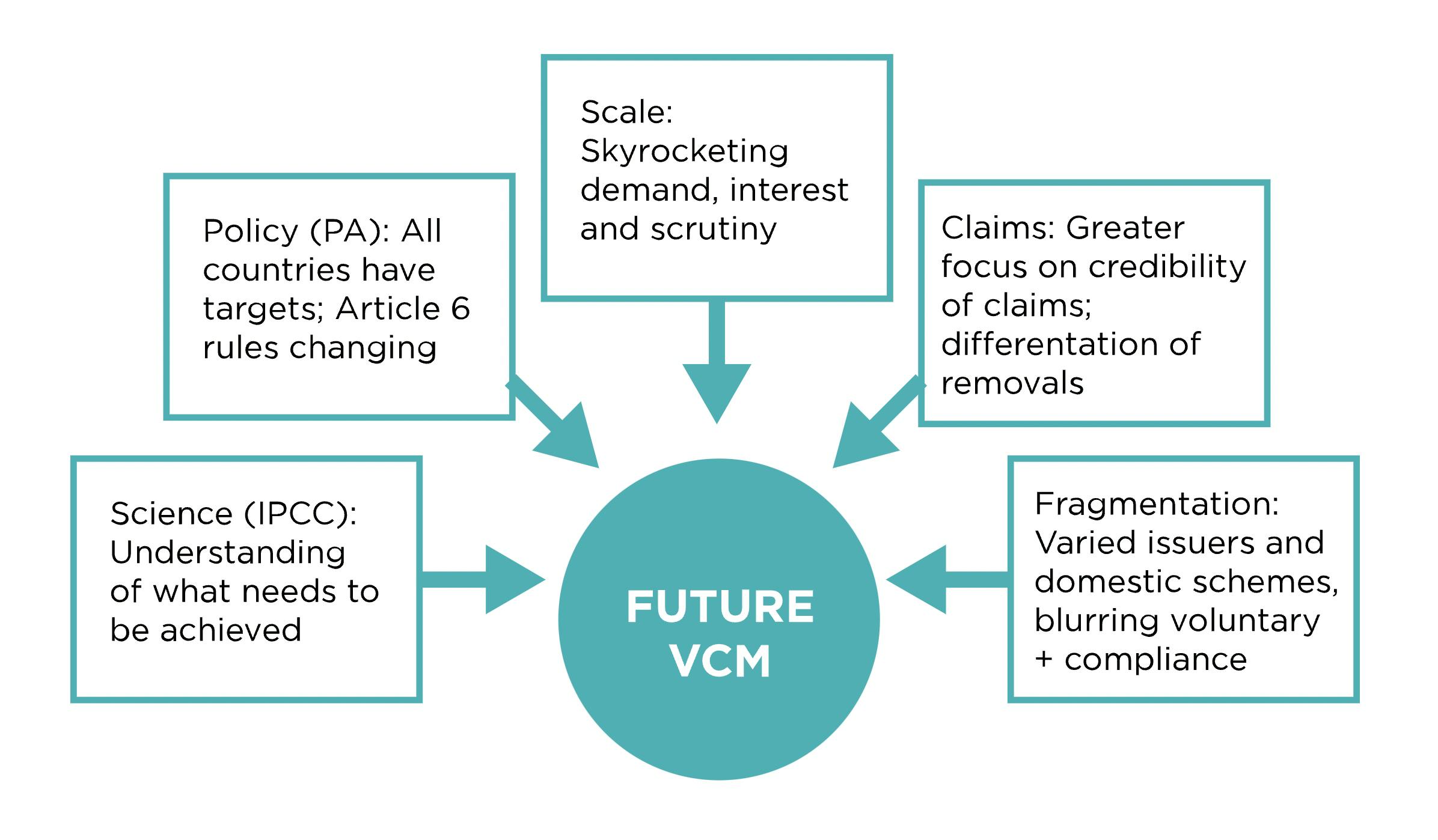

Markets have evolved since the Kyoto Protocol. Science now tells us how we need to decarbonise and by when. The Paris Agreement accordingly includes emission reduction targets for all countries, improving upon the binary nature of the Kyoto regime.

With increasing urgency for climate mitigation, many are looking to the private sector to play an increased role, with markets as one opportunity to take action. Is the zero-sum scenario of Kyoto still possible under Paris? How do we need to reshape markets to ensure they are delivering credible impact beyond business-as-usual and helping drive the transition to zero carbon?

Redefining the role of the voluntary carbon market (VCM)

From 2018-2019 Gold Standard, with support from the German Ministry for the Environment (BMU) led a working group of civil society organisations to define the role of the voluntary carbon market post-2020. Since the publication of the Working Group position paper, we have canvassed views of other civil society stakeholders at COP25 and beyond.

They confirm the view that the role of the voluntary carbon markets is to bridge the emissions gap, finance gap, and time gap under the Paris Agreement, and agree that much of the market infrastructure can support this role. The voluntary carbon market should transparently catalyse future ambition without displacing current policy ambition or corporate ambition.

Any new rules should therefore focus on safeguarding against these risks:

- Avoid displacing company action and ambition – The voluntary carbon market should be used in addition to, not instead of, setting ambitious, science-based internal reduction targets. This is linked to concerns about the appropriateness of claims like “offsetting” and “carbon neutrality” and ensuring that private sector emphasis is primarily placed on decarbonisation, using markets to finance beyond their boundaries.

- Avoid displacing country action and ambition – The voluntary carbon market should not create perverse incentives or let countries, developed countries in particular, off the hook for setting strong policy. This prompts the need to consider a transition to alignment and integration with the Paris Agreement through corresponding adjustments or other ways to support strong domestic policy, potentially with a first focus on requirements for developed countries.

The voluntary carbon market should transparently catalyse future ambition without displacing current policy or corporate ambition.

We note relative consensus on the fact that eligibility criteria and rules should be revisited to channel finance where it’s most needed, to new and/or vulnerable projects that help us reduce emissions and balance emissions with sinks by midcentury. This prompts some practical considerations for Gold Standard:

- Redefining additionality and baseline setting requirements to promote high ambition

- Limitation of crediting cycles or renewals for financially viable projects

- Restricted eligibility for CDM transition projects

- Potentially new role for carbon removals versus avoided emissions (See article on scaling Land Use)

- Incentives for strong sustainable development provisions and support for the vulnerable and marginalised

Environmental integrity:

Gold Standard carbon credits should represent highest integrity – consistent with but also potentially beyond the ambition of Paris Agreement rules – without compromising climate justice or becoming impractical to apply.

Sustainable development:

Gold Standard should represent best practice in sustainable development (SDGs, inclusivity, safeguards). Gold Standard should be universally applicable but prioritise high development impact in support of the marginalised, excluded and potentially exploited

Upcoming consultation: New rules to drive the transition

Our goal to position markets for the highest credibility and greatest impact, while avoiding barriers or disruption. We are currently preparing Gold Standard’s policy proposal for new rules and eligibility criteria. We will first have these approved by our independent Technical Advisory Committee. We will then hold a public consultation on the following important topics to ensure we understand potential challenges or risks or further opportunities:

- Role of corresponding adjustments or other means to ensure policy recognition of voluntary carbon market activity

- New requirements for additionality and baseline setting

- Eligibility for CDM projects to transition to Gold Standard

- Possibility for existing VER projects to renew crediting periods

- Principles for Gold Standard labelling in emerging compliance and domestic markets

We plan to publish these proposed new rules and eligibility criteria for consultation in May or June 2020. Review frequently asked questions about these principles for post-2020 voluntary carbon here.